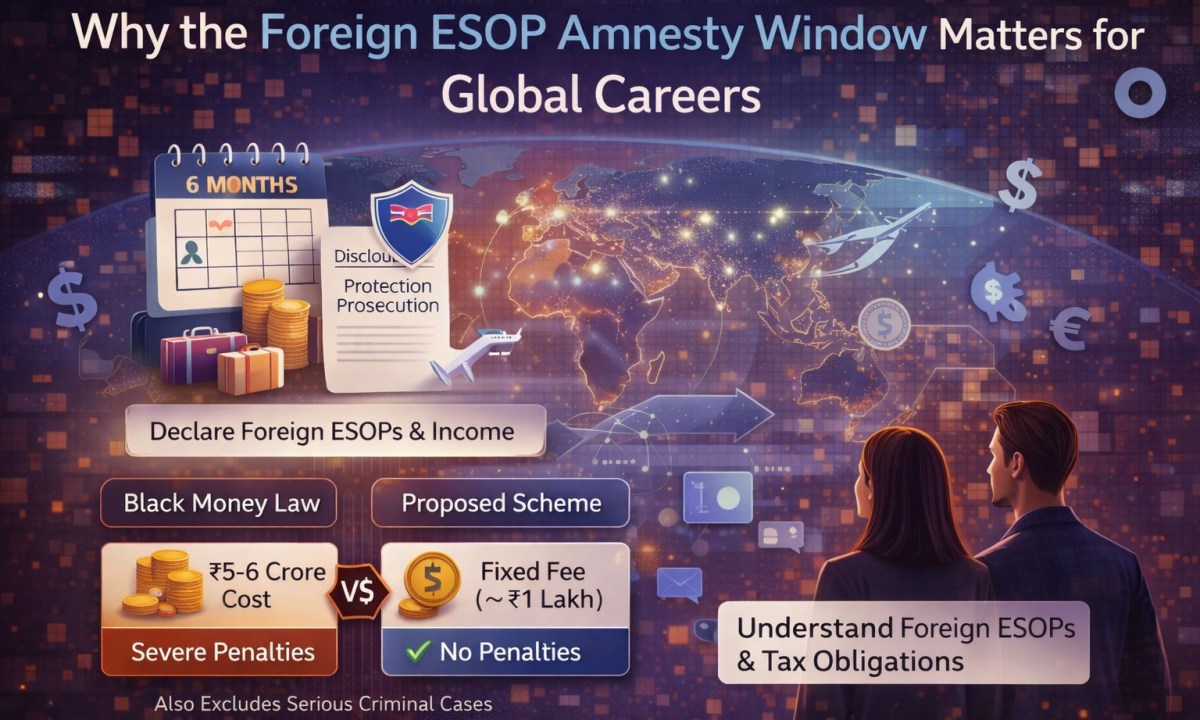

I came across a policy update that’s easy to ignore but highly relevant for young professionals and students with global career plans. The government has proposed a one-time disclosure window for foreign income and assets, including ESOPs. The goal is to encourage voluntary disclosure with low cost and no prosecution.

key Highlights

This six-month window allows residents to declare previously undisclosed foreign assets or income. It is particularly useful for those who received ESOPs from foreign employers and didn’t fully report them in past tax filings.

The financial difference can be huge. In one example, undisclosed ESOPs worth ₹5 crore could lead to over ₹6 crore outflow under strict laws. Under the proposed scheme, the cost may be limited to a small fixed fee, with penalties waived and immunity from prosecution.

The scheme works within thresholds and timelines, and excludes serious criminal cases.

What this means for a marketer (and future global professionals)

As marketers, many of us work with global firms, remote roles, or startups offering ESOPs. Compensation is increasingly cross-border. Knowing the compliance side is now part of career literacy.

For students working abroad or planning to, this is even more important. ESOPs, foreign income, and global pay structures can create tax obligations back home. Early awareness prevents expensive mistakes later.

My takeaway is simple: global careers bring global compliance. Understanding policies like this isn’t just for accountants—it’s for anyone building an international career.